Are you a company owner trying to find the ideal supplier for tax envelopes? Even though it might seem easy, picking the best supplier can significantly impact your business. Having so many options available makes it difficult to know where to begin.

Making the incorrect decision, however, may cause delays, inefficiencies, and even legal problems. But don’t worry; we’ve compiled a list of 5 crucial guidelines to assist you in choosing the best tax envelope supplier for your company’s requirements. If you heed this advice, you’ll have an easy and stress-free tax season.

1. Material Quality

When selecting a tax envelope supplier, the caliber of their materials should be considered first. Choosing envelopes composed of sturdy materials is imperative as they serve as protective barriers for your valuable tax records. The durability of the paper or other materials is important because you don’t want them to tear easily. Issues like document loss or damage could result from this.

Also, your professionalism is reflected in the quality of the envelope. Customers respect companies that protect their data. Consider it akin to putting your documents in a tidy, safe container. This preserves the contents and offers recipients a sense of dependability.

Therefore, give preference to vendors who provide sturdy and dependable materials. It’s similar to selecting a stronghold for your critical financial documents. This guarantees the safe delivery of your papers while upholding their professionalism and secrecy.

2. Security Features

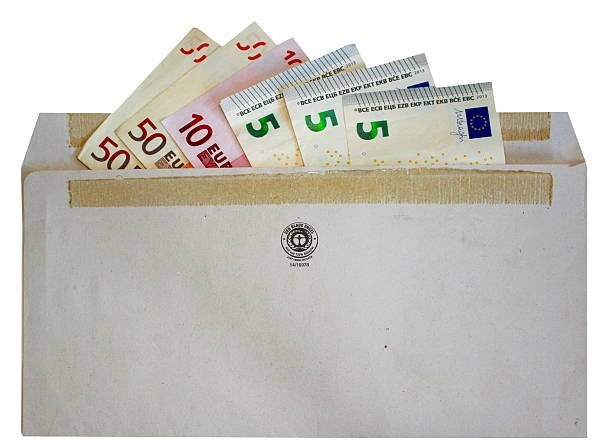

Your tax records are coded messages you must keep from prying eyes’ hands. Your selection of envelopes for these documents serves as the messages’ protectors. Thus, choosing envelopes with unique properties is crucial to protect your secrets!

These envelopes ought to be equipped with “security features.” These features act as invisible barriers that make it difficult for unauthorized individuals to peek inside the envelope. A type of shield known as “security tinting” is one of these. It’s similar to covering your documents with a magical cloak to prevent outsiders from seeing through them.

“Tamper-evident seal” is another incredible power. If someone attempted to open the envelope when they shouldn’t have, you can tell thanks to this super seal. It functions similarly to an alarm that sounds if a mischievous figure tries to take a sneak peek. Thus, to protect your vital documents, ensure the envelope providers you choose have these unique security features!

3. Customization Options

Customization options are essential when choosing a tax envelope supplier for your company. Being able to personalize the envelopes means that you can make them uniquely yours. Consider imprinting your company name or logo on the envelopes to give them a polished and individualized look. This makes your company stand out and advances brand awareness.

If the supplier allows customization, you can make the envelopes fit your needs exactly. It’s similar to receiving the ideal product instead of a universally applicable solution. Beyond just making the envelopes look better, you can customize them by adding any information necessary to relate them to your company better.

Additionally, selecting a provider with good customization choices guarantees that the tax envelopes complement your brand. Therefore, consider the freedom and flexibility a tax envelope supplier offers to customize the envelopes to meet your company’s particular needs when making your decision.

4. Price and Time of Delivery

Let’s say you want to buy something and you’re at a store. You consider when you’ll receive it and whether it’s worth the money in addition to the price. Purchasing tax envelopes by a business works in the same way.

The price tag on your envelopes represents the cost. You must consider your budget as much as you want high quality. But it goes beyond simply selecting the least expensive option. It would be best to strike a balance between the price and the quality of the envelopes. Nobody wants envelopes that open and close!

Let’s now discuss delivery times, like waiting for a package to arrive at your house. When placing an online order, you anticipate receiving your item promptly. As tax season draws near, companies must receive their tax envelopes on time. It’s not fun if the envelopes arrive late!

Therefore, companies must inquire about the fastest delivery time for envelopes from the envelope supplier. It is a huge plus if the supplier can deliver them promptly. Businesses experience a similar feeling as receiving their tax envelopes on time, like when they receive their favorite video game right before the weekend.

5. Size and Format

Envelopes should be sized differently for different tax documents. Some are larger than a birthday card, and some are smaller than a postcard. As puzzle bags must fit puzzle pieces, selecting envelopes that precisely match your documents is crucial. This keeps your tax documents organized and prevents them from crumbling.

Think of it this way: if you try to fit a big puzzle piece into a small bag, it won’t work, right? The same goes for tax documents and envelopes. It would therefore be ideal to have a supplier who offers you options for various sizes.

Conclusion

Choose a tax envelope supplier wisely, focusing on quality, customization, security features, and proper sizing. A dependable supplier provides long-lasting, secure envelopes that meet your company’s requirements for organized financial records and tax compliance during tax season.